Budget 2025 is just around the corner, and expectations are running high. Corporate India is looking forward to “tax reforms, lower GST rates, and regulatory updates,” while also anticipating announcements about capex allocation during Finance Minister Nirmala Sitharaman’s eighth Budget speech on February 1, 2025. Meanwhile, taxpayers are hoping for some relief for the middle class, especially given the current economic challenges.

For live coverage and updates, you can also follow “Sitharaman’s Union Budget 2025 speech on lawmonitor.in and their Budget live blog.”

Tax Reforms Are Complete, Says Finance Minister (4:13 PM IST)

Finance Minister Nirmala Sitharaman declared that the work on simplifying income tax is now complete. This announcement follows the recent changes introduced in the New Tax Regime under Union Budget 2025.

Focus on Bihar’s Development in Union Budget 2025 (3:56 PM IST)

Bihar remains a key focus in Budget 2025, with Finance Minister Nirmala Sitharaman unveiling several development initiatives. These include the establishment of a Makhana Board, a National Institute of Food Technology, new greenfield airports, and the expansion of IIT Patna. Additionally, the West Kosi Canal Project in Mithilanchal has been proposed. These measures come ahead of Bihar’s upcoming Assembly elections.

Press Conference Scheduled to Address New Tax Regime Queries (3:53 PM IST)

Finance Minister Nirmala Sitharaman is set to hold a press conference at 4 PM, where she is expected to address questions related to the New Tax Regime 2025.

Stock Market Closes Flat Post-Budget (3:48 PM IST)

The stock market ended the day with minimal movement. The BSE Sensex closed at 77,505.96, a slight increase of 0.01%. Zomato was the top gainer with a 7.17% rise. In contrast, the Nifty 50 closed slightly lower at 23,482.15, with BEL experiencing the biggest drop of 4.1%.

What Budget 2025 Means for Students (3:41 PM IST)

Budget 2025 brings good news for students. The government plans to add 10,000 new medical seats across the country this year as part of a broader goal to create 75,000 medical seats over five years. To manage the doubling of student enrollment in 23 IITs over the past decade, additional infrastructure will be developed in newer IITs, accommodating 6,500 more students. The government will also offer 10,000 PM Research Fellowships and establish three Centres of Excellence in Artificial Intelligence with an allocation of Rs 500 crore.

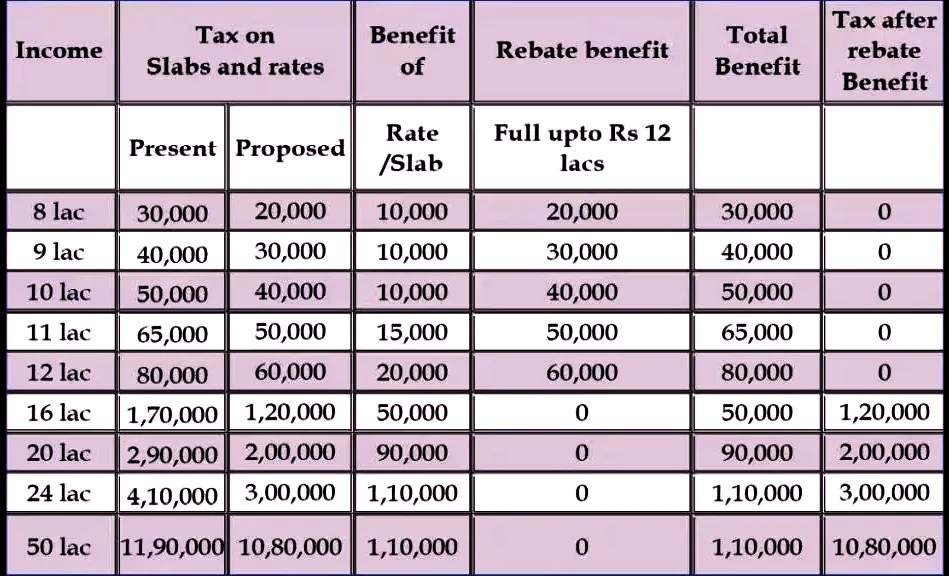

New Tax Regime 2025: Rebate Benefits Explained (3:26 PM IST)

Under the new tax regime, taxpayers with income up to Rs 12 lakh can avail rebate benefits:

- Rs 20,000 rebate for income of Rs 8 lakh

- Rs 30,000 rebate for income of Rs 9 lakh

- Rs 40,000 rebate for income of Rs 10 lakh

- Rs 50,000 rebate for income of Rs 11 lakh

- Rs 60,000 rebate for income of Rs 12 lakh

No rebates are available for incomes above Rs 12 lakh. Rebate does not apply to income from capital gains, lotteries, or incomes taxed at special rates.

Stock Market Expected to End Flat (3:07 PM IST)

The stock market was projected to close flat, with the BSE Sensex indicating a close at 77,577.15, up slightly by 76.58 points or 0.1% from the previous day.

Standard Deduction in New Tax Regime 2025 (3:05 PM IST)

Yes, a standard deduction of Rs 75,000 is available under the new tax regime. This means salaried individuals with an income of up to Rs 12.75 lakh (before deduction) won’t have to pay any tax. In comparison, the old tax regime offers a standard deduction of Rs 50,000.

PM Modi Calls Budget 2025 ‘The Budget of Aspirations’ (2:46 PM IST)

Prime Minister Narendra Modi hailed Budget 2025 as a significant milestone in India’s development. He described it as “the budget of aspirations for 140 crore Indians,” emphasizing that it aims to fulfill the dreams of every citizen and empower the youth to drive the nation’s growth.

14:35:15 (IST)

Who Will Benefit from the Budget 2025 Tax Cuts?

The new tax regime will benefit various groups, including individuals, Hindu Undivided Families (HUFs), associations of persons (excluding co-operative societies), bodies of individuals (whether registered or not), and artificial legal entities. The changes in tax slabs will positively impact all these categories.

14:22:10 (IST)

Budget 2025: The Real Impact Goes Beyond Money

Experts believe that the biggest win in Budget 2025 isn’t just financial. The focus is on building trust through simpler tax systems, making compliance fair and easy. With no tax on incomes up to ₹12 lakh and clearer deductions, taxpayers will feel more confident. Extended deadlines for filing returns, simplified TDS rates, and higher TDS limits are expected to boost voluntary compliance. According to policy expert Vivek Agarwal, the real victory is behavioral—clarity replacing confusion and increased trust in the system.

14:00:02 (IST)

Five Key Goals for Self-Reliance in Pulse Production

Finance Minister Nirmala Sitharaman announced five major goals to boost self-reliance in pulse production:

- Development of climate-resilient seeds

- Improving protein content

- Increasing productivity

- Enhancing post-harvest storage and management

- Ensuring better prices for farmers

13:53:18 (IST)

Union Budget 2025: Major Highlights on Personal Income Tax Reforms

Key takeaways from Finance Minister Nirmala Sitharaman’s speech:

- Special focus on the middle class, emphasizing their role in India’s growth.

- Continuous efforts to reduce the tax burden since 2014, with the ‘nil tax’ slab increasing from ₹2.5 lakh to ₹7 lakh over the years.

- Now, no income tax will be payable on incomes up to ₹12 lakh under the new regime.

- For salaried taxpayers, this limit extends to ₹12.75 lakh due to a standard deduction of ₹75,000.

- The new tax structure aims to reduce middle-class taxes, boosting household spending, savings, and investments.

13:51:12 (IST)

Budget 2025: Tax Cuts to Boost the Middle Class and the Economy

Experts highlight that reducing the tax burden will increase disposable income, encouraging higher consumption. Shishir Baijal notes that this move addresses the challenge of declining private consumption. Indraneel Chitale adds that the tax exemption up to ₹12 lakh will boost liquidity, drive consumer spending, and support sectors like FMCG, which have faced slow growth recently.

13:40:19 (IST)

Tax Benefits Extended to Two Self-Occupied Houses

In a significant policy shift, Finance Minister Nirmala Sitharaman announced that taxpayers can now claim tax benefits on two self-occupied homes. Previously, this benefit was limited to just one property, making this a major relief for many homeowners.

Budget LIVE: A New Step Towards Building a Developed India – Shekhawat

Union Minister Gajendra Singh Shekhawat shared his expectations from the budget, stating that it will be a strong and new step towards the welfare of the poor and the commitment to making the country more developed. We just need to wait a little to see what discussions unfold, as patience always leads to sweet outcomes.

Budget LIVE: Thank You for Wearing the Madhubani Saree – JD(U) MP

JD(U) MP Sanjay Kumar Jha expresses his gratitude on behalf of the entire Mithila and Bihar regions, saying, “I thank Finance Minister Nirmala Sitharaman for wearing a saree with Madhubani painting while presenting the Union Budget today. We were with her when Padma Shri awardee Dulari Devi gifted her the saree in 2021. She had requested the Finance Minister to wear it while presenting the budget. I appreciate her for wearing it today and sending a meaningful message. By doing so, she has honored the Mithila region and Bihar.”

The President served curd and sugar to the Finance Minister

President Droupadi Murmu served the traditional “curd and sugar” to Union Finance Minister Nirmala Sitharaman before she presented the budget. Today, Finance Minister Nirmala Sitharaman will present her 8th consecutive Union Budget in Parliament.

Budget 2025 Highlights

1. Income Tax Relief

2. Increase in Standard Deduction

3. Higher Limit for Section 80C Deductions

4. Benefits for Senior Citizens

5. New Schemes for Women

6. Increase in PM-Kisan Scheme Assistance

7. Higher Limit for Kisan Credit Card (KCC)

8. Possible Changes in NPS

9. More Benefits for Senior Citizens

10. Enhancements in Atal Pension Yojana (APY)

Read in Detail: Budget 2025 Highlights: Key Announcements to Watch Out For

Union Minister meets President Droupadi Murmu

Union Finance Minister Nirmala Sitharaman and Minister of State for Finance Pankaj Chaudhary met President Droupadi Murmu at Rashtrapati Bhavan. Today, Finance Minister Nirmala Sitharaman will present the Union Budget in the Lok Sabha.

Budget Should Prioritize Public Welfare: Vipin Maheshwari

As the Union Budget 2025 is set to be presented in Parliament today, rail passengers are sharing their expectations. Passenger Vipin Maheshwari expressed his views, saying, “The budget should focus on public welfare; otherwise, it loses its significance. It should bring tangible benefits to the people, and efforts must be made to control inflation.”

Nirmala Sitharaman Departs from Finance Ministry

Union Finance Minister Nirmala Sitharaman has left the Finance Ministry to present the Union Budget in Parliament. This time, instead of the traditional ‘bahi khata,’ she will be using a tablet to read and present the budget.

Budget 2025: Full Schedule Details

- 8:15 AM: Finance Minister Nirmala Sitharaman will arrive at the Ministry of Finance and participate in a photo session with her budget team.

- 8:45 AM: She will meet the Hon’ble President to get formal approval for the budget.

- 9:15 AM: The Finance Minister will reach the Parliament.

- 10:00 AM: A Cabinet meeting will be held to give final approval to the budget.

- 11:00 AM: Sitharaman will present the Union Budget 2025 in Parliament.

Read More: Budget 2025: Full Schedule, Live Streaming Details, and How to Watch on Mobile

Budget 2025 LIVE: What Can Uttar Pradesh Expect from the Union Budget?

The blueprint of Uttar Pradesh’s budget will largely depend on the allocations in the Union Budget 2025. Expectations are high for income tax relief and a reduction in the burden of other taxes. All eyes are on how much support UP will receive through centrally sponsored schemes and its share in the central allocations.

It is anticipated that UP might receive around ₹3.90 lakh crore this time. After the Union Budget announcements, the UP government will finalize its own budget plans. In the 2024-25 budget, UP was allocated ₹3.63 lakh crore across various sectors.

Budget 2025 LIVE: Nirmala Sitharaman Arrives at Finance Ministry, To Present Budget at 11 AM

Finance Minister Nirmala Sitharaman has arrived at the Finance Ministry. From here, she will head straight to Rashtrapati Bhavan, where President Droupadi Murmu will give her approval for the budget. Following this, a meeting of the Union Cabinet will be held to finalize the budget. Sitharaman will then present the Budget 2025 in Parliament at 11 AM.

Auto Industry’s Budget Expectations

The auto industry is urging the government to reduce the GST on helmets from 18% to 12% in the upcoming budget. Additionally, the industry has recommended making logistics 100% electric by 2030 to promote sustainability and efficiency.

ऑटो इंडस्ट्री ने सरकार से अपील की है कि बजट में हेलमेट पर लगने वाले जीएसटी को 18% से घटाकर 12% किया जाए। इसके अलावा, इंडस्ट्री ने लॉजिस्टिक्स को 2030 तक पूरी तरह इलेक्ट्रिक बनाने की सिफारिश भी की है, जिससे पर्यावरण और कार्यक्षमता में सुधार हो सके।

What the MSME Sector Expects from the Budget

Laxmi Venkataraman Venkatesan, founder and managing trustee of the Bharatiya Yuva Shakti Trust, highlights a major concern for micro-entrepreneurs: timely and adequate access to credit. While fintech companies and NBFCs process loans within a few days, traditional banks still take 2-3 months, causing unnecessary delays.

Currently, under the MUDRA scheme, the average loan amount in the Shishu category is ₹37,000, which is insufficient for micro-entrepreneurs to effectively expand and sustain their businesses. To ease financial strain on small businesses, she suggests:

- Increasing loan amounts

- Offering interest subsidies of up to 4%

- Reducing margin money requirements from 25% to 10%

- Lowering processing fees

Additionally, she recommends reducing loan processing and guarantee fees to 0.25% to make borrowing more accessible and affordable.

Budget 2025: Gold Industry Urges Reduction in Import Duty

The gold industry is calling for a further reduction in import duty on gold. In the previous budget, the import duty was lowered from 15% to 6%. Now, experts and industry leaders are hopeful that in Budget 2025, the duty will be further reduced to 3%. They believe that lowering the import duty will bring Indian gold prices closer to global benchmarks.

Possible Major Changes in the New Tax Regime

With Budget 2025 approaching, further significant changes are expected. Here are some potential updates to the new tax regime:

Higher NPS Deduction Benefits: Employees making voluntary contributions of up to ₹50,000 in the National Pension System (NPS) may receive additional tax deduction benefits.

Tax-Free Income Limit Increase: The tax-free income threshold may be raised from the current ₹3 lakh to ₹3.5 lakh per year.

New Tax Slab for Higher Incomes: A new tax slab could be introduced for taxpayers earning between ₹15-18 lakh annually, with a 25% tax rate.

Budget 2025 Expectations: Annual Income Up to ₹10 Lakh Will Become Tax-Free?

Vimal Nadar, Senior Research Director at Colliers India, stressed the need to rationalize tax slabs to make the New Tax Regime more appealing.

He suggested introducing a 25% tax slab for incomes between ₹15 lakh and ₹20 lakh, which could provide much-needed tax relief and enhance disposable income. According to Nadar, this increase in liquidity could significantly boost consumption. Additionally, he emphasized that exempting incomes up to ₹10 lakh from tax would greatly benefit middle-class salaried individuals by improving their financial stability and purchasing power.

Budget 2025: Will FM Sitharaman Tackle Rising Costs and Boost Affordability?

India’s affordability issues in food, housing, and clothing are taking a toll on the economy. As Budget 2025 approaches, all eyes are on Finance Minister Nirmala Sitharaman to provide solutions. The budget could offer immediate relief through subsidies while laying the groundwork for lasting reforms. Tax breaks for the middle class, job creation initiatives, and targeted sectoral reforms could pave the way for economic stability and reignite consumer confidence.

Union Budget 2025 Live Updates: Kerala Pins High Hopes, Says Minister K N Balagopal

As Union Finance Minister Nirmala Sitharaman prepares to unveil the Union Budget for FY 2025-26 on February 1, Kerala is eagerly anticipating solutions to its long-standing financial challenges with the Centre. Kerala’s Finance Minister K N Balagopal expressed the state’s high expectations from the upcoming budget.

Balagopal revealed that Kerala has sought a special financial package along with additional relief for the rehabilitation of Wayanad landslide victims and support for the Vizhinjam International Port. “We presented our detailed demands during the pre-budget meeting in Jaisalmer last month. Kerala has faced significant financial cuts, and we have urged the Centre to address these issues,” he said.

Highlighting the country’s economic concerns, Balagopal expressed hope that the budget would acknowledge the unique financial pressures India is facing and introduce measures to boost growth. “Reports from NITI Aayog and the RBI indicate that we are falling short of our projected financial growth. The Centre needs to roll out initiatives that put money directly into people’s hands. I am optimistic that the Union finance ministry will act accordingly,” he added. (PTI)

Budget 2025: Govt should Focus on Empowering MSME Food Processors, Says Saket Chirania

The upcoming Union Budget 2025 holds immense potential for transformative growth in the food processing sector, according to Saket Chirania, Co-Founder of Agrizy.

Chirania emphasized the need for the government to prioritize policies that boost the competitiveness of Micro, Small, and Medium Enterprises (MSMEs) in food processing, calling them “critical drivers of innovation and job creation.”

He highlighted the importance of financial incentives and subsidies for adopting sustainable processing technologies. “Such support will enable businesses to meet domestic and international quality standards,” he said. Chirania also advocated for dedicated funding for research and development to enhance food safety and drive product innovation, ensuring Indian products can excel on a global scale.

Another key focus, he noted, should be investing in skill development programs tailored to the food processing workforce. “This is essential to build a skilled and capable talent pool,” Chirania added.

He concluded by stating that a forward-looking budget could unlock the true potential of India’s food processing sector. “It can drive economic growth, strengthen food security, and position India as a global leader in processed foods. Let’s work together to create an ecosystem that benefits farmers, processors, and consumers alike,” he said.

Budget 2025 LIVE Updates: Big Announcements Expected Today!

The stage is set for the Union Budget 2025, which will be presented in Parliament today. Finance Minister Nirmala Sitharaman is all set to unveil her eighth budget speech in the Lok Sabha at 11 AM. The preparations are complete, and before heading to Parliament, she will first visit the Rashtrapati Bhavan to get the President’s approval. Following that, the budget will receive the Cabinet’s nod.

There’s a wave of anticipation across markets, businesses, and policymakers as they await key announcements that could bring significant changes to the economy. This budget holds special significance as it’s the first full-fledged budget of the Modi 3.0 government.

So far, Nirmala Sitharaman has presented five full budgets and two interim ones during the NDA government’s tenure, making today’s presentation her eighth in Parliament. From the salaried class to farmers and the underprivileged, everyone is hoping for some much-needed relief. Will there be changes in income tax slabs? Any new job creation schemes? Will the government announce measures to tackle inflation? The answers will be revealed shortly.

Budget 2025 LIVE: What to Expect?

The nation has high hopes from this comprehensive budget. The government might roll out major employment initiatives, offer tax reliefs to the salaried class, and announce substantial packages for farmers. However, all eyes are particularly set on potential changes in the income tax structure. Stay tuned for live updates as the budget unfolds!

Key Updates on Budget 2025;

- Budget LIVE: Thank You for Wearing the Madhubani Saree – JD(U) MP